Using Trading Central's "Economic Insight" investors can check out up-coming major economic data.

We are looking into the trading week of September 1-5:

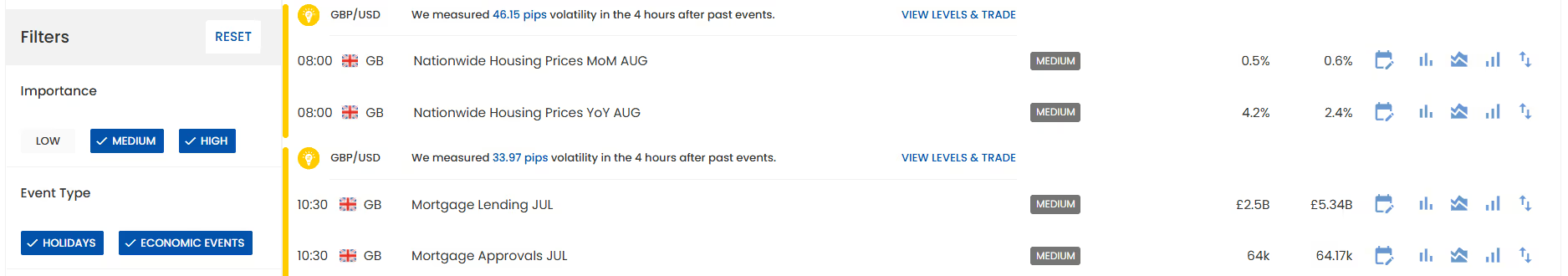

We can select economic data of "High", "Medium" or "Low" importance, or any combination of such filters:

We can select which major economies to focus on:

In the past week, U.S. data showed that Core Personal Consumption Expenditure (PCE) price inflation rate ticked up to 2.9% year-on-year in July.

And gross domestic product (GDP) grew at an annualized rate of 3.3% in the second-quarter, faster than expected.

Meanwhile, the Federal Reserve is still widely expected to cut interest rates by 25 basis points on September 17.

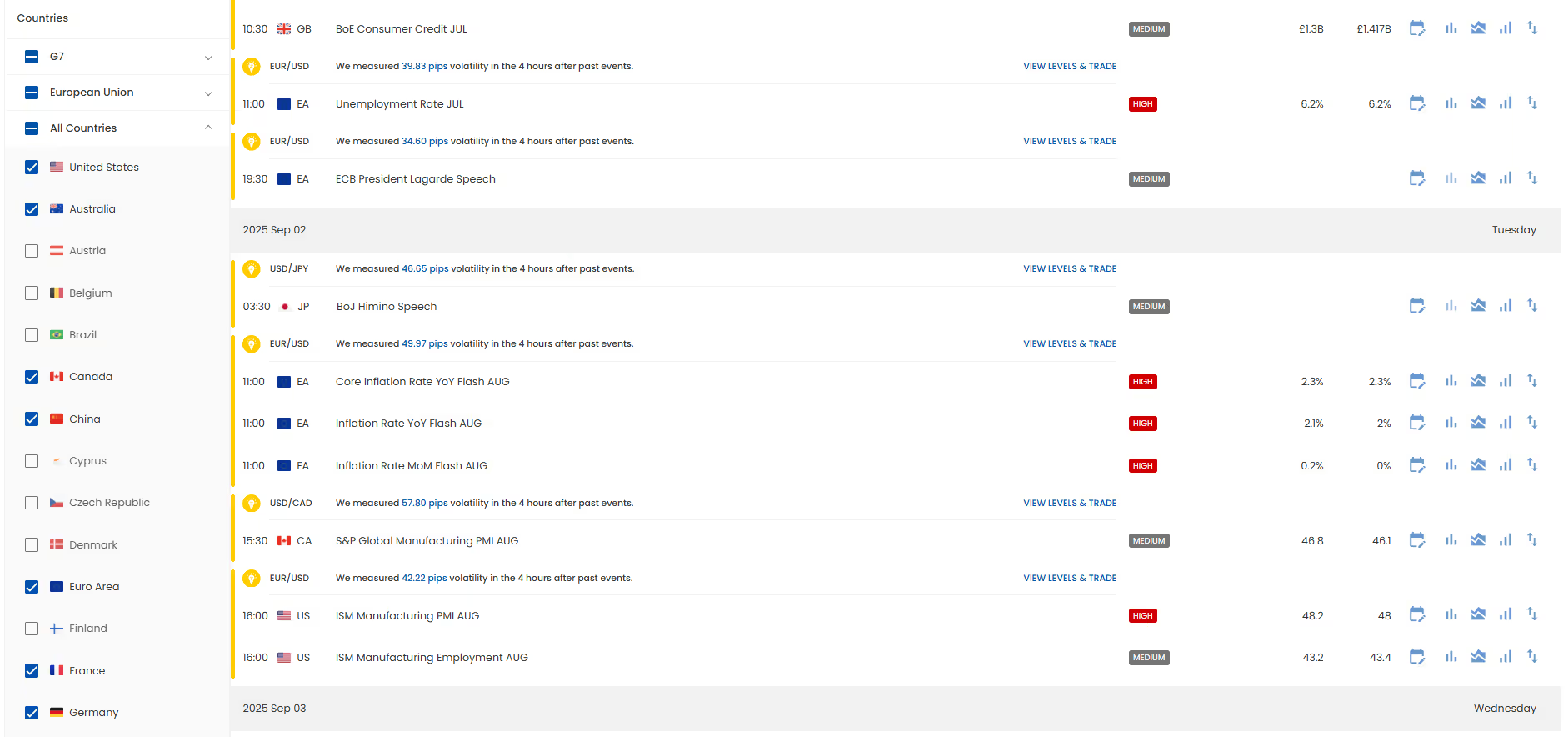

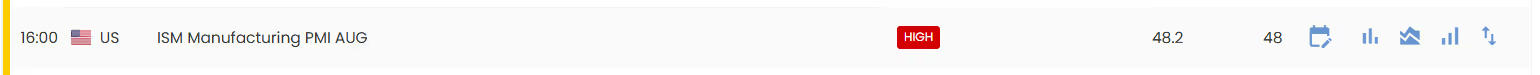

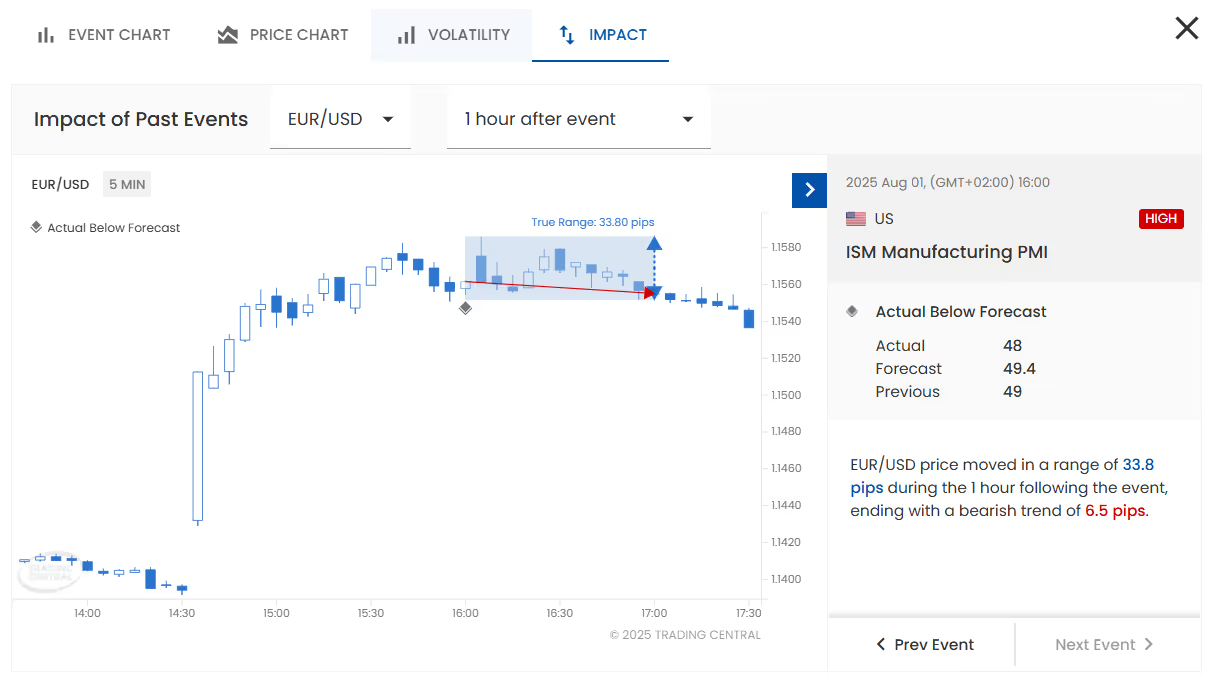

The Institute for Supply Management (ISM) Manufacturing Index (due Tuesday, September 2) should be the focus of the coming week. The index has been showing Contraction Readings (below 50) since February.

According to Trading Central's "Economic Insight", the U.S. ISM Manufacturing Index is expected to tick higher to 48.2 in August.

In August, within one hour from the release of the ISM Manufacturing Index, EUR/USD moved in a range of 33.8 pips, ending 6.5 pips lower.

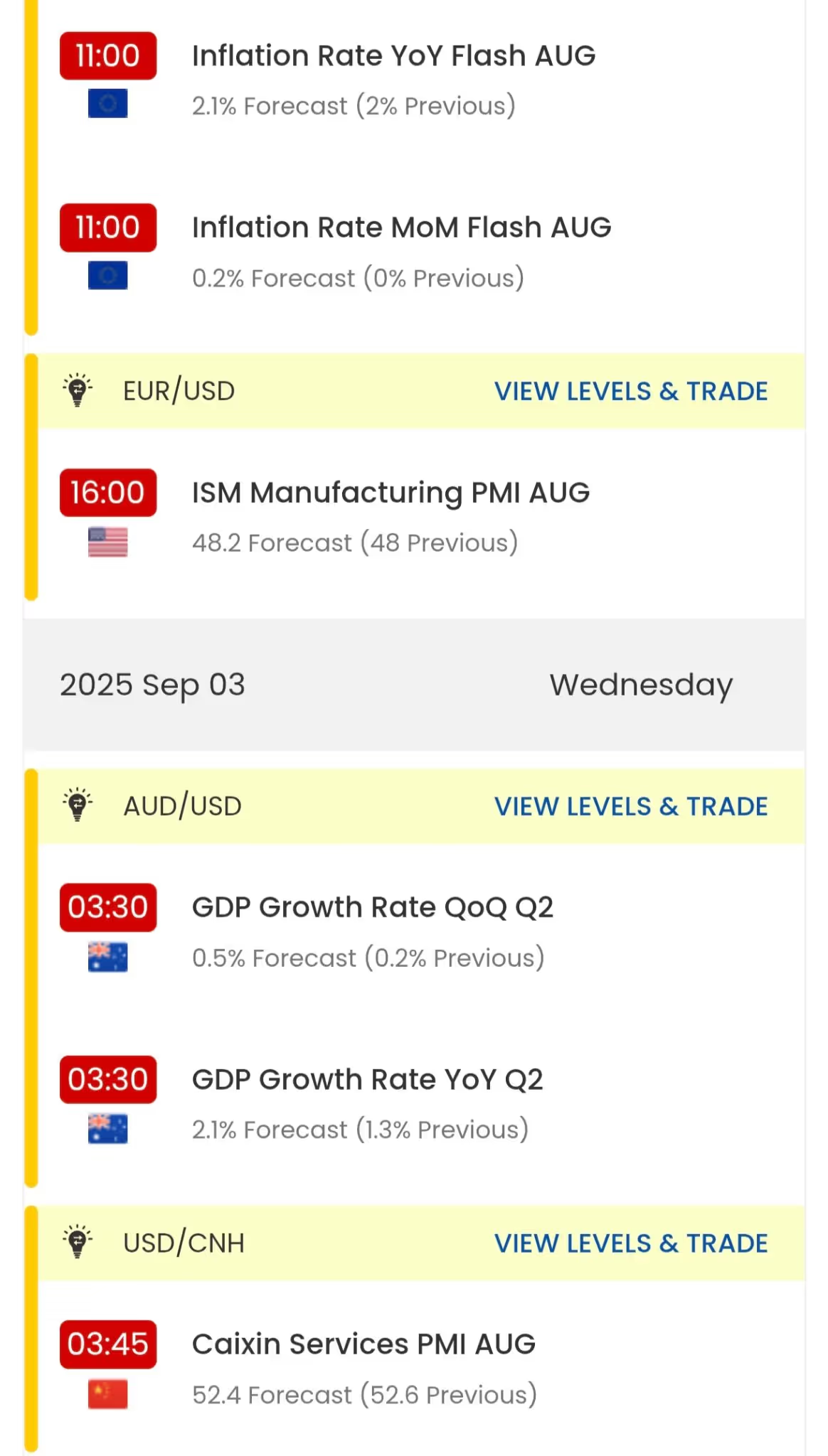

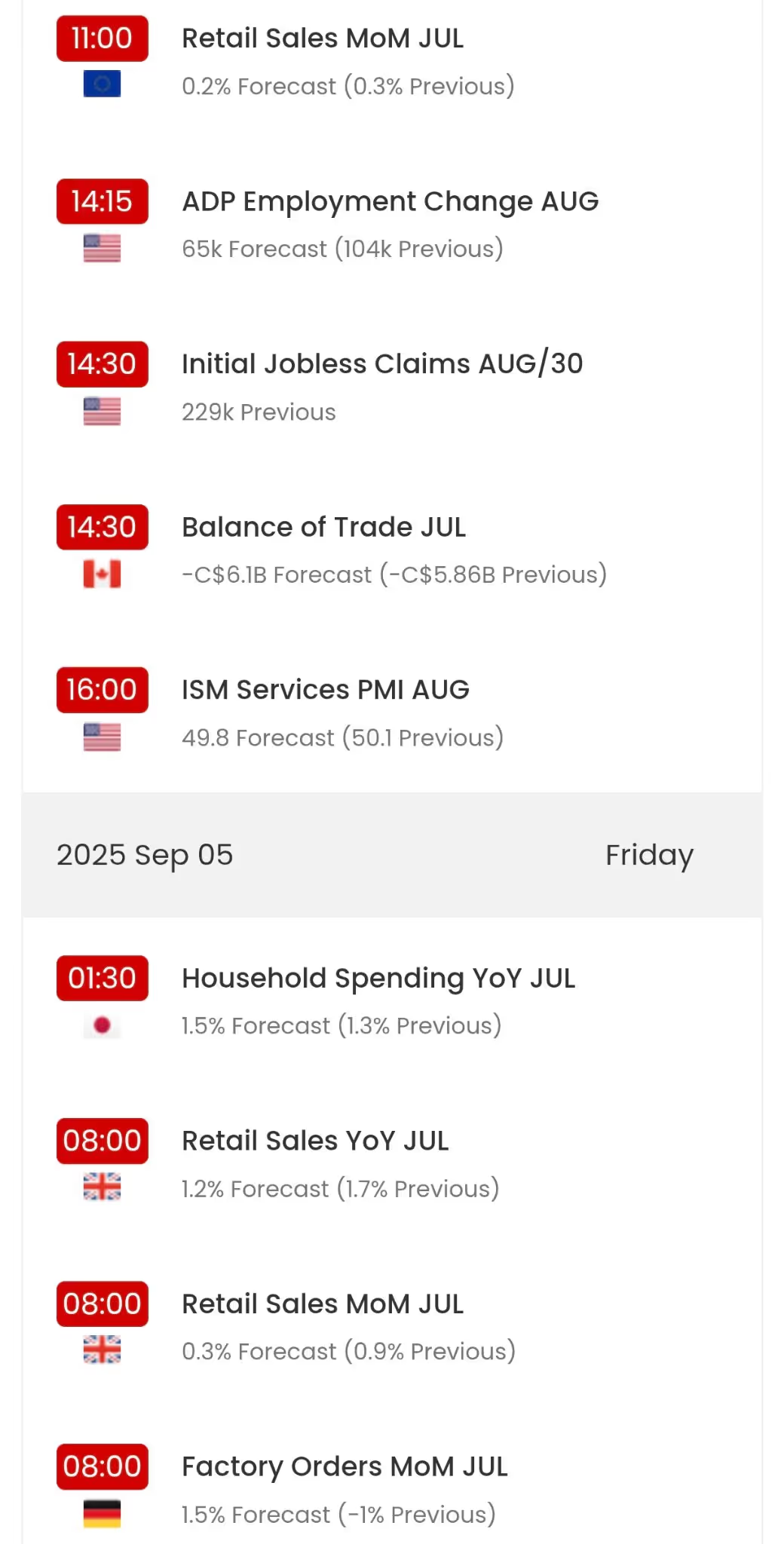

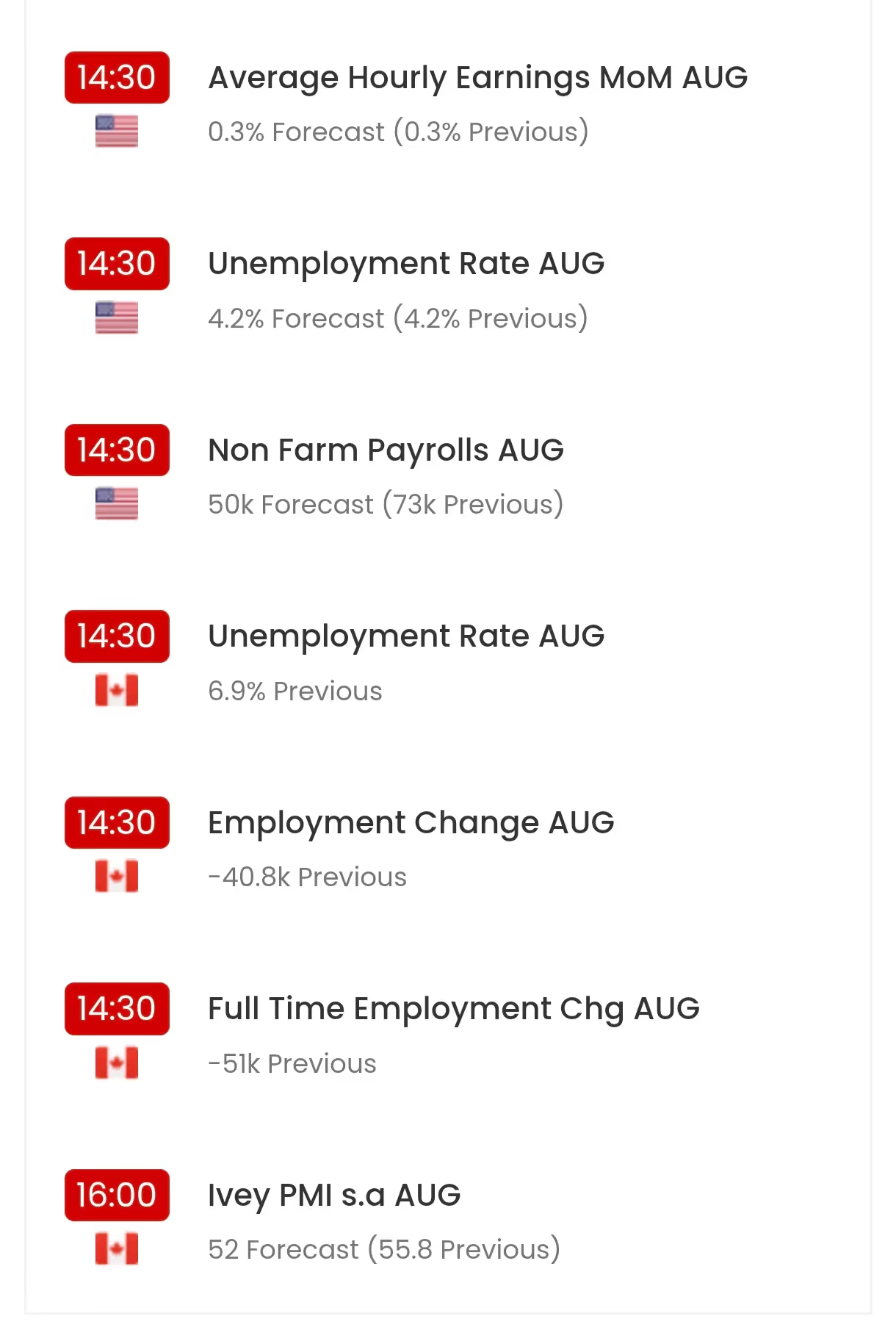

Key Economic Data Forecasts:

(GMT+02:00 Hour)

Happy Trading!

Source: Trading Central Economic Insight